Food prices are about to skyrocket even more; Prepare for a 'famine,' followed by housing crash, then equities wipeout - Michael Gayed

According to a new report, food prices are about to skyrocket to a point that this country hasn't seen in decades. This means that it is more important than ever to stock up on food now. If you wait until the prices go up, you will likely be forced to pay much more for the same items. Inflation is also expected to rise, so the cost of food will continue to increase over time.

Food prices are about to skyrocket even more; Prepare for a 'famine,' followed by housing crash, then equities wipeout - Michael Gayed

Now is the time to stock up on food so that you can save money in the long run. If you have the space, consider buying in bulk. This will help you save even more money on food costs. Don't wait until it's too late to stock up on food - get started today

In the short term, food prices are going to skyrocket. This is due to a number of factors, including inflation and the increasing cost of food. If you wait until the prices go up, you'll be forced to pay more for the same items. A cart of groceries used to cost approximately $300, but now that same cart costs over $500.

Is the United States heading towards a famine?

The long-term effects of the food crisis are still unknown, but it's clear that we need to take action now. If you have the space, consider buying in bulk so that you can save money in the long run. We're talking about the price of wheat, soybeans, corn, meat, and dairy all doubling or even tripling in price. If the situation in Ukraine and Russia continues to worsen, we could see food prices quadruple in the next year.

Is the United States about to experience a housing crash?

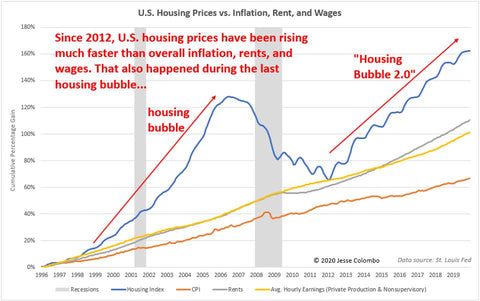

The housing market is also expected to crash soon. This is due to a number of factors, including the food crisis and inflation. If you're thinking about buying a house, now is not the time to do it. Wait until the prices go down before you make your purchase. The housing market crash in 2008 happened when the prices of houses peaked at $200,000. The current average price of a house is $360,000, so it's only a matter of time before the market crashes again. We are in a mega housing bubble 2.0, and mark my words, the crash is coming.

What will happen to stocks if the housing market crashes?

The stock market is also expected to crash if the housing market crashes. This is because investors will lose confidence in the economy and they will sell their stocks. If you have any money invested in the stock market, now is the time to sell so that you don't lose all of your money.

The bottom line is this: we are heading towards a major economic crisis. This is due to a number of factors, including the food crisis, inflation, and the housing market. If you're not prepared, you could lose everything. So take action now and stock up on food so that you can survive the coming economic crisis.

If you're not sure where to start, try looking for food deals at your local grocery store. You can also check online for food prices and compare them to find the best deals. No matter how you do it, make sure you stock up on food now so that you're prepared for the future. We sell all kinds of bulk emergency food to get you started from bulk freeze dried fruit, 25 year shelf life meat buckets, soup buckets, and BPA Free Water Containers to store water. We are offering 5% off automatically at checkout and Free Shipping on orders over $199. Pick up some freeze-dried foods for it SHTF.

You're Not Imagining It: Inflation Is Costing You Hundreds More Each Month

As record-high inflation swells, and food and gas prices continue to climb -- many of us are feeling the effects on our wallets. US families are paying an average of $311 more per month for everyday essentials and services, according to a May report from economists at Moody Analytics.

While talks of a recession make their rounds, it's important to stay calm and focus on what you can control. For instance, many are considering a side hustle to add extra padding to their bank accounts. But if you'd rather tackle your budget to unlock savings, consider these road-tested spending strategies that may help offset inflation's toll.

How to save money on food

- Consume carefully. As we've reported, 40% of food waste comes from our kitchens. But shopping with more precision, consuming leftovers and taking inventory inside your kitchen cabinets before hitting the grocery store are savings strategies that support sustainability while keeping more money in your bank account.

- Go frozen. In the past, I equated buying fresh fish and produce with the best possible quality. But in recent years, especially now that our family has doubled in size, I love frozen options such as greens, berries for smoothies and filets of fish. With advances in rapid deep-freeze tech, the quality is just as good when thawed -- and you can save easily 30% to 50% on the price. To that end, we've invested in a separate freezer where we store bread, cheese and other quick-to-perish foods to boost their shelf life by an extra three to six months.

- Diversify where you shop. Don't only hunt for sales at the supermarket. Check for deals at drug stores, dollar stores and even big-box retailers (which are expanding their fresh food and pantry offerings), sometimes at a lower price than grocery stores.

- Shop store brands. Whether you're at Costco or Whole Foods or the local supermarket, keep an eye out for the store's own private label. You can usually find these products in the pantry and fresh food aisles. The quality of store-label goods is just as solid (in my opinion) as the name-brand variety and they sell for as much as 25% to 50% less.

- Buy discounted gift cards for eating out. Gift card resale sites like Raise and CardCash let you buy discounted cards from a variety of brands. You can often find solid savings on cards tied to chain restaurants, as opposed to grocery stores, which tend to sell out faster. For example, on CardCash I found a gift card to Subway for 10% off.

How to save money on gas

- Sign up for fuel savings programs. You can usually shave 5 to 10 cents off every gallon of gas by signing up for fuel savings programs at your favorite gas pump. They're typically free and can be accessed via mobile phone. For example, BP has an app-based gas rewards program that saves members 5 cents per gallon.

- Search for the cheapest gas. There's an app for that! Gasbuddy, for example, will use your location to identify the cheapest gas nearest to you.

- Bring cash to the pump. Some fuel stations offer a small discount for customers who pay with cash, as opposed to credit.

- Renegotiate car insurance. On a related note, if you're driving less than you were before the pandemic and have yet to call your car insurer to ask for an adjustment to your insurance premium, you should. Driving less means that you're at less risk for accidents and flat tires, so while this isn't a way to save on gas, you may be able to earn some money back on car insurance to bulk up your gas budget.

How to save money on utilities

- Ask for discounts. Negotiating with your providers and billers is always a wise practice -- from your cable provider to your streaming service to your utilities company. Speak with customer retention and let them know that you want to save money and see what they offer you.

- Drop a streaming service. With everyone from Netflix to Hulu announcing an increase in monthly subscription costs, consider dropping one streaming service. Maybe it's the one you use the least or that you joined simply because of a single show that's now ended its season. You can renew next year when it's back. If you can't keep track of your subscriptions, there are apps like Truebill that will scan your bank account to identify all of your subscriptions -- and even help you cancel them for a fee.

How to save money on travel

- Don't wait. Our colleagues at The Points Guy recommend booking flights and vacation packages sooner rather than later. Prices are still relatively good since business travel still hasn't recovered and they're seeing some good deals for hot spots like Florida and Mexico.

- Bank on unused card points or miles. We just used our card points that we'd been racking up as rewards during the pandemic to buy round-trip flights to go out west to see our family. The trip was essentially free thanks to card points that had been collecting dust over the last two years of the pandemic.

- Consider a local trip. If you're not into flying right now, explore your own community with a staycation. If you moved to a new locale during the pandemic and haven't ventured out much, this could be a great time to explore surrounding attractions. While you're planning, take note of your various affiliations to score discounts on car rentals and museums. Students, AAA members and AARP card-holding members can often earn discounts. In New York, residents can apply for the IDNYC card, which unlocks so many perks, including free entrance to museums. Check your city for similar programs.